Our aim is to empower people to use complex financial products and benefit from the advantages of the digital transformation.

We use digital technologies to enable our customers to make the best possible decisions. Our products fulfill three criteria: They are identity-based, can be integrated into existing customer solutions and provide information in real-time.

In compliance with the highest security standards, we integrate identity-related account information into the analysis of the customer situation and thereby create the best possible basis for decision-making.

Accessibility is crucial for establishing successful solutions. Our products can be easily integrated into any IT environment and any payment system.

BO1 provides relevant information via cloud in real time. This way, our customers know immediately whether they can afford the upcoming transaction and under which conditions.

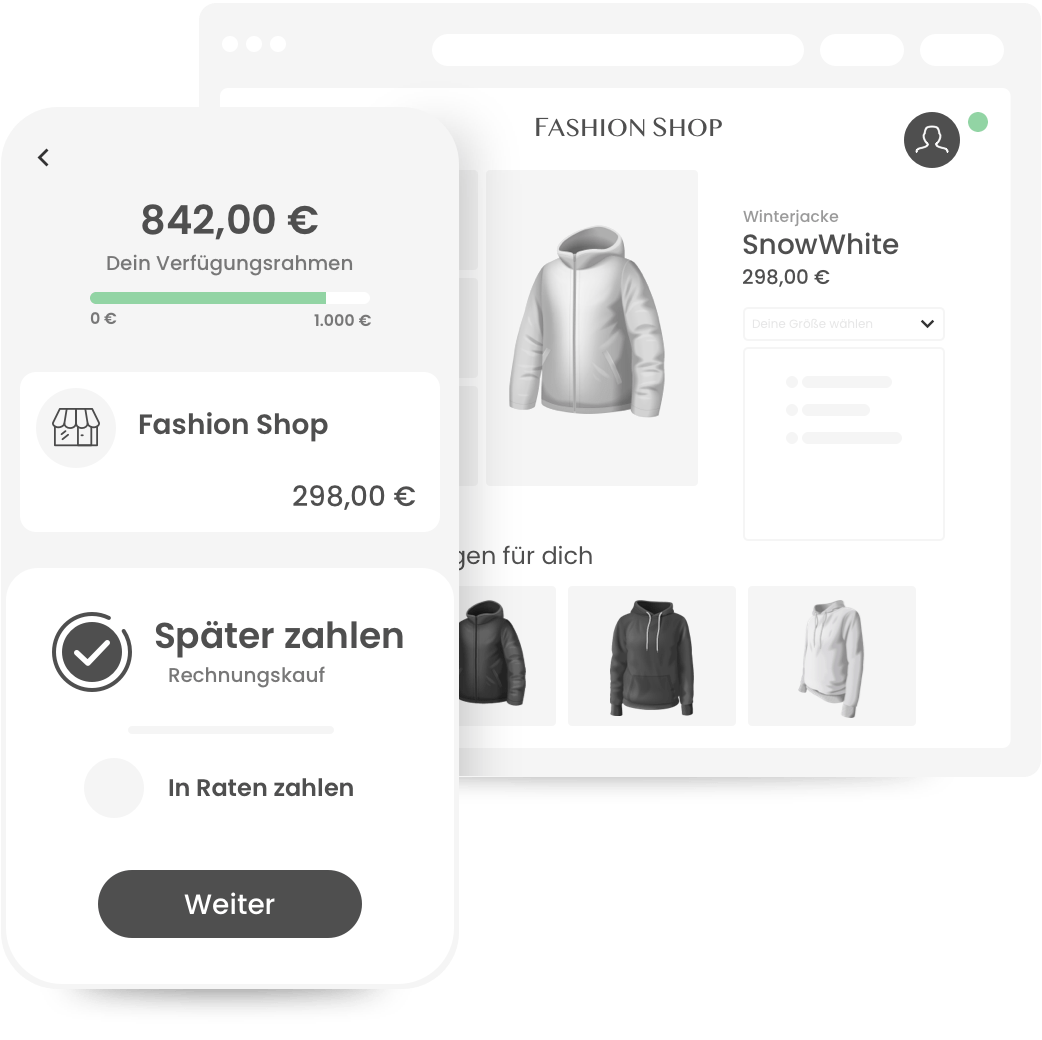

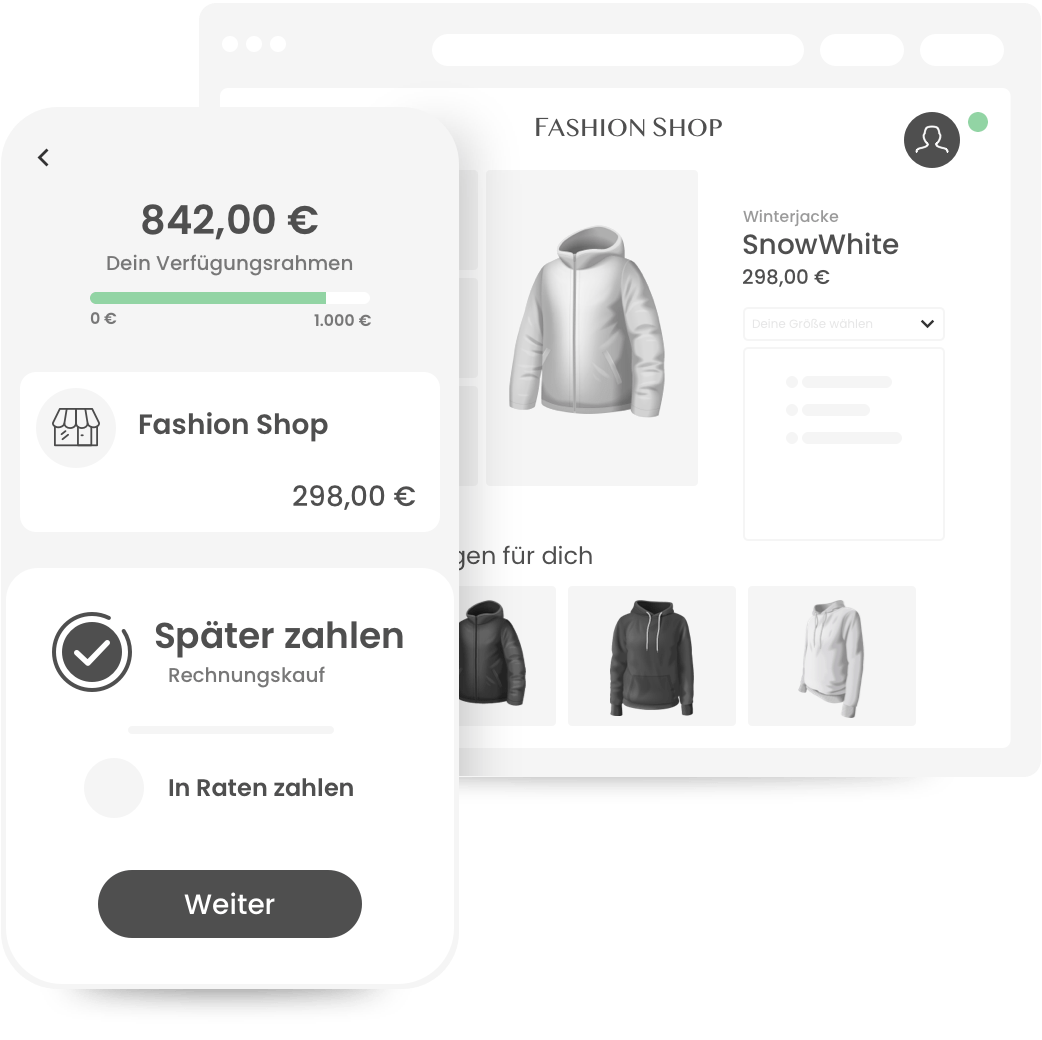

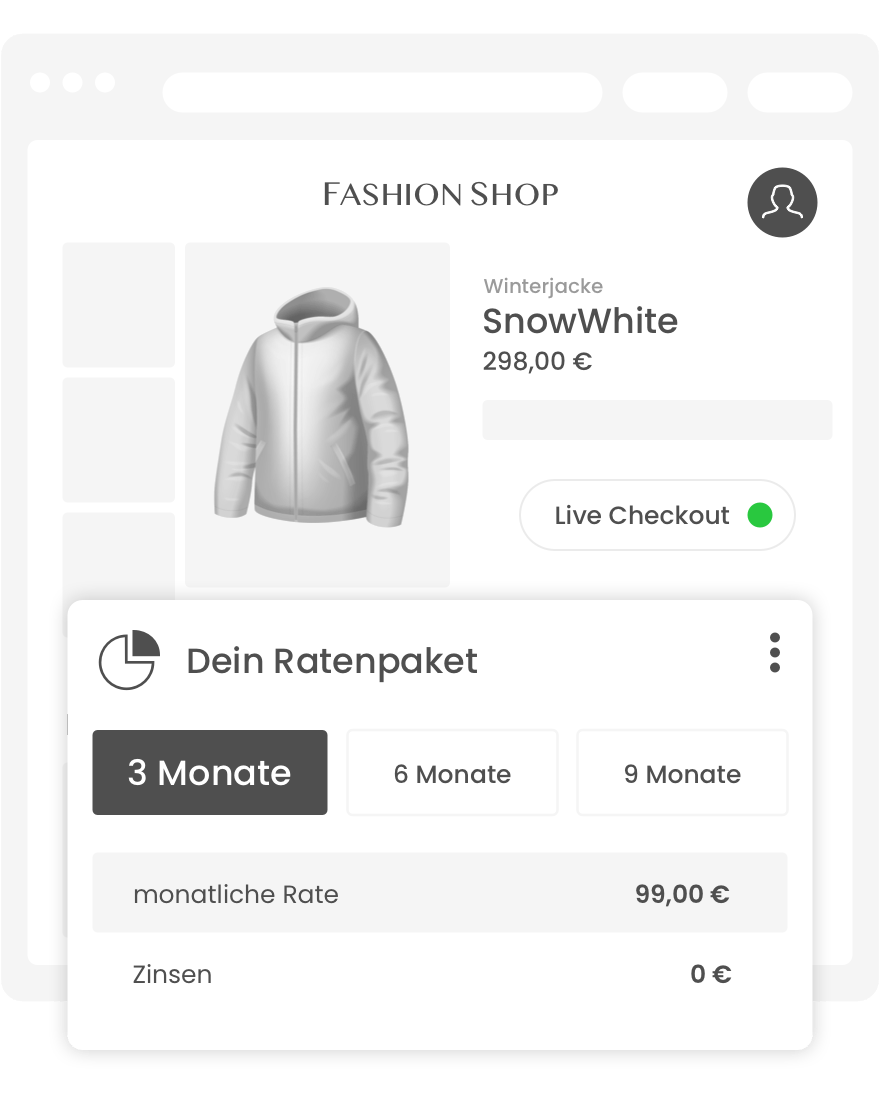

Paydentity will offer Buy Now, Pay Later and installment payments with a built-in credit check and can be integrated both in online stores and at the point of sale in stationary retail.

Using the Open Banking API of our PSD2 partner, we access account data on behalf of the customer and carry out a credit check independently of Schufa. Paydentity calculates a score value from the collected data and determines the amount of the credit line for the end customer in real time.

The amount of the credit line is always up-to-date and corresponds to the financial possibilities of the consumer.

Paydentity’s omnichannel capability enables all parties involved to offer a seamless and cross-channel shopping experience – stationary, mobile and online.

This gives retailers the advantage of being able to offer innovative payment methods online. This enables them to achieve higher sales and remain competitive.

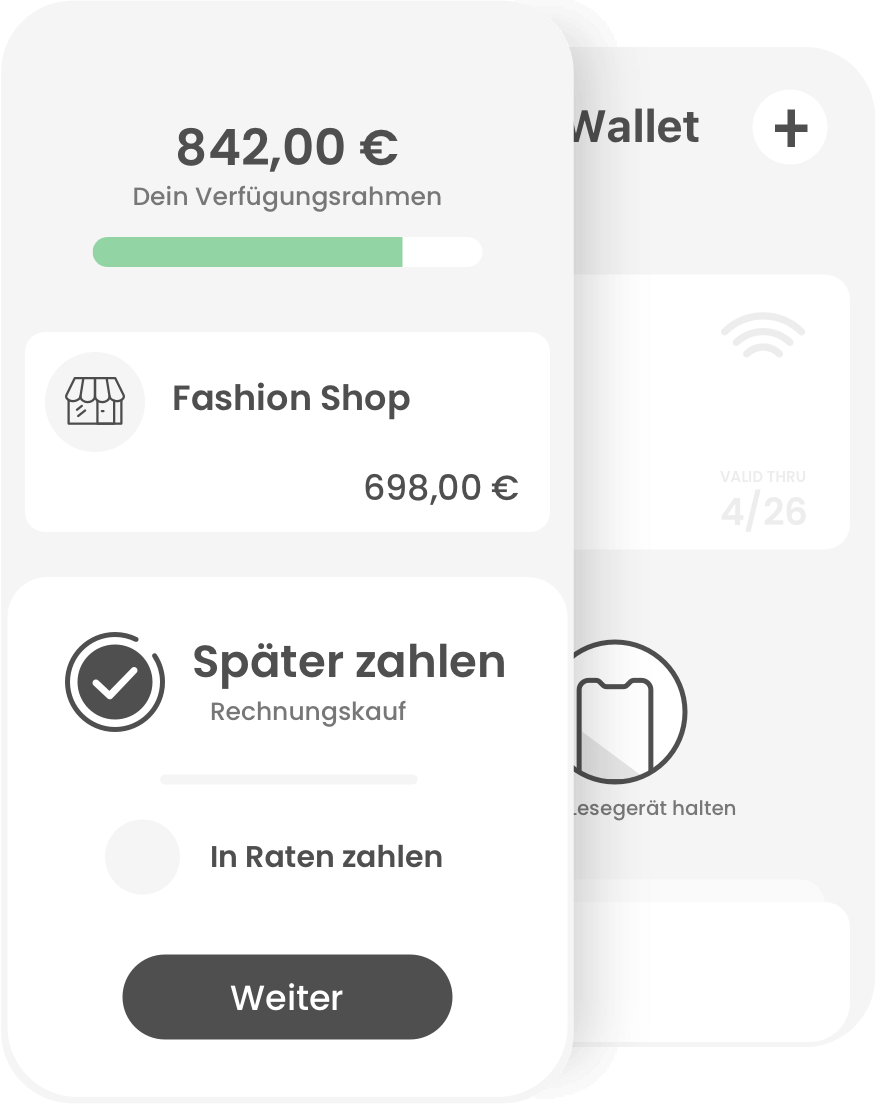

Contactless payment with Paydentity via app at the card terminal is simple. With the virtual Paydentity card, the purchase takes only a few seconds. Customers can choose between the payment methods Buy Now, Pay Later, Instalment Payment or Immediate Purchase.

Paydentity provides all online shop operators with an optimised and user-friendly checkout process directly on the product – including the Paydentity scoring engine to enable the Buy Now, Pay Later, instalment and direct payment methods to also be offered online.

The app developed in the native Android and iOS versions offers a selection of different payment methods, an open banking interface for account overview and a Paydentity card that can be integrated into the wallet.

For NFC-enabled cell phones, we use Host Card Emulation (HCE) to communicate with the payment terminals.

The Paydentity platform acts as a central service and message broker and coordinates communication between all partners involved.

In the interface to the payment service providers, we provide the APIs for the exchange of information and the execution of the payment transaction process steps.

The business processes include:

Paydentity’s predictive payment approach is an innovative, easy-to-set-up plug-in solution that makes the payment process simpler and more transparent. Paydentity offers customers and merchants flexible payment methods.

The system-immanent pre-scoring engine gives each customer an individual credit limit. This minimizes default risks and thereby increases security for both merchants and customers.

The cooperation makes it possible to offer the payment methods direct payment, Buy Now, Pay Later (BNPL) and payment by instalments at POS terminals in stationary retail stores.

Cookies sind nichts schlimmes. Sie erleichtern die Bereitstellung unserer Dienste. Weitere Informationen findest du in unserer Datenschutzerklärung.